Economy and political agenda

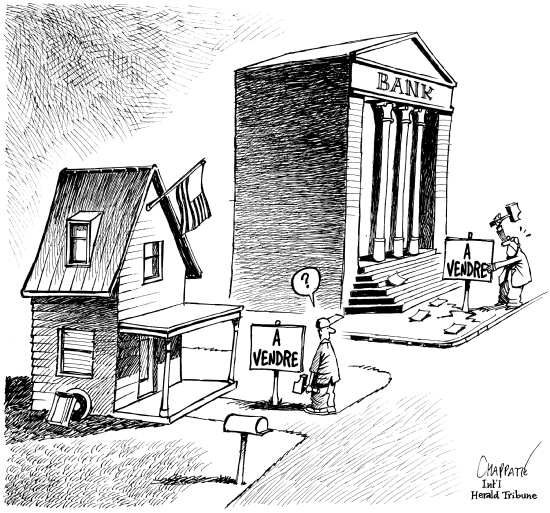

Nobel Prize winner Joseph Stiglitz judges that “the subprime crisis is not over” in the United States and Europe, and that this crisis is linked to the surge in oil and food prices, in an interview with the French newspaper Release Saturday. “The subprime crisis”, American subprime mortgage loans, “is not over”, affirms Mr. Stiglitz, explaining that with the fall of the real estate market in the United States, more and more Americans find themselves unable to repay their mortgages, linked to the value of their homes. The former chief economist of the World Bank, who was also economic advisor to former US President Bill Clinton, adds that in terms of employment “there are fewer working hours on the market”, a “clear sign that the economy is sick”. He also predicts that in “2008, the American deficit will reach “500 billion dollars”, and that the United States therefore “no longer has the means to stimulate the economy”. Europe will continue to suffer from the crisis born in the United States because “many European banks have bought these subprime derivative products and are suffering the repercussions”, and because the weakness of the dollar vis-à-vis the euro favors American exports at the expense of European ones . For Mr. Stiglitz, the oil boom, the food riots, the financial crisis and the threats of recession are “linked”. “The oil crisis is linked to the situation of the war in Iraq. That of subprime, a consequence of the war and the rise in oil prices. The food crisis, via the rise of biofuels, is the result of the oil crisis”, he argues. (06/07/2008, L’Echo)

It is important to have a clear idea of what is happening now. The connections made by Mr. Stiglitz between the variables are a bit strange, perhaps influenced by the American electoral agenda. We cannot blame everything on the Iraq war.

First of all, the 2008 oil crisis is only partially linked to the war started in 2003 in Iraq. The latter would in fact only be responsible for 10 to 20% of the increase in the price of a barrel. The sub-prime crisis is also not directly linked to the war but to the fact that speculation has taken over the real estate market. In the context of the very low interest rates determined by the Federal Reserve to emerge from the consequences of the previous speculative cycle (the “Internet bubble”), it was tempting to offer credit to poorly creditworthy households and it was possible to pay on the rate difference. Base rates subsequently rose again, and speculators were caught in a pinch.

It is in a context of monetary disorders – implicitly desired decline in the dollar to finance American state deficits, effectively fueled by military spending, relative rise in the euro due to European monetarism – that the Fed once again lowered its rates to support the economy and avoid a stock market collapse. As investments in dollars became less attractive, hedge funds then seized the commodity markets – oil, gold, agricultural commodities – deemed more lucrative. The rise in oil prices fueled inflation, pushing the ECB to maintain high rates which pushed the euro upwards, while the dollar continued to fall due to less positive expectations for business in the United States.

China’s growing energy demand and biofuel subsidies have been aggravating factors in the energy and food markets, but are not the real cause of the crisis.